The Future is Now

Steven Cavan

A few months ago, the Indian government withdrew 86% of banknotes in circulation. Ostensibly, it was to cut down on the black market economy and tax cheats, but it also wiped out a large percentage of the wealth of the poorest people, who hold their wealth in cash. A few weeks later, Venezuela followed with a similar measure.

People waiting in line to deposit bank notes before the deadline. The 500 and 1,000 rupee notes were scrapped.

This got me thinking, to what degree do people control their own wealth today, and should they have more control?

For most of human history, individuals had very little control of their own wealth. Warring tribes raided villages and all-powerful kings and emperors could seize your property on a whim. If you worked hard and managed to accumulate some wealth, it wasn’t entirely clear that you would be able to keep it, so most people were content to keep their head down, eke out a meager existence, and not draw too much attention.

But something important happened in the 17th century as property rightswere established. In the Second Treatise on Civil Government (1689) John Locke wrote:

everyman has a property in his person; this nobody has a right to but himself. The labor of his body and the work of his hand, we may say, are properly his

- John Locke

This began a shift in society, where people could keep more of the proceeds from their work. It also meant that your position (class, caste, etc) was not set at birth. With hard work, you could be self made, and create a better life for yourself and your children.

With upward mobility becoming possible, people began creating new products and services, hoping to strike it rich. Innovation began to accelerate, which improved life for everyone, rich and poor. In some cultures, it eventually became more favorable to be viewed as self made versus being born into wealth — a stark contrast from the age of kings and emperors.

Paul Graham writes that, “a great deal has been written about the causes of the Industrial Revolution. But surely a necessary, if not sufficient, condition was that people who made fortunes be able to enjoy them in peace.”

Not only did letting people control their own wealth accelerate innovation, it also attracted the best and brightest to certain countries. In the United States, for example, 51% of billion dollar tech startups are started by immigrants.

Unfortunately, this idea has not taken hold everywhere in the world. India seizing bank notes is just one small example. Here are some recent examples from around the world:

It’s unfair to characterize governments as the only way to lose control of wealth. Seizing funds or hyperinflation are a major problem, but wealth can also be taken by companies or stolen by individuals. We must look holistically at how much control people have of wealth to think about how to increase it.

A lot has been written on this topic, but here is my take on the pros and cons of people having more control of their wealth.

The question here is whether the economic growth from people working harder, more ideas being tried, and attracting the best talent outweighs the downside of income inequality, increased volatility, and enabling bad folks along with the good.

I do think digital currency represents an unprecedented opportunity to increase people’s control of their own wealth in the world. But there are pros and cons to this approach.

This video gives a sense of how digital currency can empower people with more control of wealth.

With each of these cons there is cause for optimism when you look at how they are changing over time.

Governments exist to serve their citizens. One could argue that the Indian government recalling bank notes had a positive impact on citizens (more tax revenue for education, roads, etc). Yet it also harmed millions by eroding their wealth. This delicate balance of power between individuals and governments has been in flux throughout history, and it’s helpful to have some checks in place to ensure it doesn’t get too far out of alignment.

Digital currency can be one of those checks, because it provides an opportunity for people all over the world to gain more control of their money. With universal access to smartphones, it will likely spread rapidly to every country in the world. This increase in control for individuals will probably stimulate a great deal of economic growth, and improve the human condition. But it will also introduce some uncomfortable changes into society and has a long way to go, improving security, volatility, and usability, to be compelling to a more mainstream audience. If digital currency can overcome these challenges (and I think it can), it will establish controlling your own wealth as a basic human right for anyone in the world.

Steven Cavan

The price of Bitcoin has been growing steadily in what seems to be a recovery from the setback it suffered on Wednesday, January 18 following reported allegation of irregularities in the operations of major exchanges in China by the People’s Bank of China (PBOC).

Officials of the Bank had met with key exchanges – BTCC, OKCoin and Huobi – on January 11 to remind them of their responsibility to conduct their activities according to the laws of the country. The news of the meeting dipped the price of Bitcoin from the $916 range to as low as $761 due to panic selling which emanated from fears that the onsite inspection could jeopardize investment in the digital currency.

However, after a review of messages from all indications – the PBOC, the exchanges and cryptocurrency insiders, nothing new came out of what was misconstrued for a ban in some quarters aside reiterating what the Chinese government had earlier established about Bitcoin and other digital currencies not being legal tender in China.

It is not new for a ban on cryptocurrency-related activities to come to mind when it comes to China as the country is estimated to be handling about 90% of the world’s Bitcoin operations and holdings. This is a view that has been held for long and hinged on the need for the digital currency’s distribution to be considered a geopolitical risk exposure.

The PBOC’s involvement in bitcoin trading could lead to regulation of the industry. Image from Shutterstock

Rather than a ban in this instance, the government called for a “self-examination” which, in retrospect, means the exchanges and other stakeholders’ need to manage the digital currency’s price fluctuation responsibly owing to the price sudden rise in the first few days of 2017.

The CEO of Decent, Matej Michalko, blamed the “bad players” for the situation. He says in a chat:

“The heated discussion about BTCC compliance with People’s Bank of China showed a palpable misunderstanding of context. The point was to adopt the set of regulatory policies called AML/KYC, that calls for detailed anti-corruption due diligence information sharing and anti-money laundering. Bitcoin came under fire because of the outright abuse of the technology. Various people avoided capital outflow laws and transferred large sums of money, what grabbed the attention of financial agencies. Fault isn’t precisely on the state, nor currency itself, but on the bad players.”

The Chinese government’s expressed concern seems to indicate that it wants to see the price of Bitcoin remain stable. And that was what has been seen in the market for the following days. After the dramatic drop, the price started building up again from January 13 moving between the $801 and $831 range for four days when Theresa May’s speech on the Brexit plan triggered interest in Bitcoin.

It gained more than $80 in the less than 24-hours that followed until the news came out that the results of the PBoC probe into China exchanges would be released on Friday, January 20. The $913 height was back to $864 but has been climbing back to $877 (according to CoinMarketCap) as at the time of this writing.

While it is clear that China has not come down hard on Bitcoin and its recent involvement could be seen as a legitimate concern that could obliquely publicize Bitcoin as recognized by the government, what would happen in the next few days would be critical for Bitcoin owing to the caution that is being exercised presently by the three most influential exchanges in China as well as observing Bitcoin investors.

It is unclear whether the price stability that is currently at play will be sustained for longer to bring about the real growth that is anticipated in the long term based on predictions that 2017 would be a better year for Bitcoin. However, what is clear is that the quick spike to over $1000 in the first five days of the year has put all the major stakeholders on alert and we just have to wait to see what the year would bring for Bitcoin.

Source: https://www.cryptocoinsnews.com/pboc-bitcoin-exchanges-bright-side/

Dennis Roeder

Markethive Member

skype: daroeder

Steven Cavan

Russian Authorities: Bitcoin Poses No Threat, Won’t Be Banned

Source: https://www.cryptocoinsnews.com/russian-authorities-bitcoin-poses-no-threat-wont-banned/

Russia’s deputy finance minister has now stated that the country’s Central Bank and the Federal Financial Monitoring Service do not see any threats in the use of cryptocurrencies like bitcoin.

More notably, the much-publicized and long-deliberated bitcoin ban by the Bank of Russia will not be pursued any longer, the bank’s deputy chairwoman Olga Skorobogatov revealed.

According to a report by Russia’s largest news agency, TASS, the Russian Federation’s Deputy Finance Minister Alexei Moiseev – who notably spearheaded the effort to ban bitcoin from 2014 – is now adopting a wait-and-see approach with the cryptocurrency.

“We will discuss this law [to ban bitcoin] in the current session of Parliament, and possibly even pass it then, or at the very latest by spring next year,” said Moiseev in September 2014. “We are currently dealing with comments from the law enforcement agencies, about the specifics of legal measures, and we will take their remarks into account. But the overall concept of the law is set in stone.”

Having consulted with those experts over the past two years, amid considerable opposition by other Russian governmental authorities against the Finance Ministry’s proposed bitcoin ban bill, Moiseev has now told reporters that bitcoin poses no threat. This, despite comments by Russia’s Investigative Committee chairman Alexander Bastrykin who claimed that bitcoin posed “ a real threat to the financial stability of Russia”, in 2016.

In statements reported by TASS, the deputy finance minister stated:

"So far, we decided just to watch carefully how it is developing. We decided that teh Central Bank and the Federal Financial Monitoring Service should monitor cryptocurrency for Russia’s economic security. So far, these agencies believe that there is nothing critical [as a threat] in it. That means that they [the threats] may appear in the future, but now they do not exist."

The comments represent a remarkable turnaround for an official who vehemently pushed for the approval of the bitcoin ban bill through the Russian house of Parliament. One draft of the ban infamously proposed a 7-year prison term for bitcoin use in Russia, less than a year ago. Ban No More

In statements echoing those made by the Minister of Finance, deputy chairwoman of the Bank of Russia Olga Skorobogatova has separately stated that the central bank will not be taking prohibitive measures with the use of bitcoin.

In statements reported by regional publication CryptoRussia, the central bank official stated:

"With Bitcoin – a private currency, it became clear that [regulation] was not simple. Regulators and authorities agree that they would not like to specifically prohibit [Bitcoin]. [We] would instead like to understand it and on this basis build a regulatory framework."

The telling statements come within months of Moiseev stating that the ban proposal was on hold. While bitcoin could possibly see regulation in Russia, the adoption, mining or use of the cryptocurrency will no longer be considered a criminal offence.

Tell the world about your business with the biggest and best Marketing Network on the Internet.

Dennis Roeder

Markethive Member

skype: daroeder

Steven Cavan

Bitcoin at parity with Gold

Bitcoin at parity with GoldYesterday evening at 1700 GMT the value of bitcoin surpassed the value of gold, this is the first time any currency has reached that level, could this mean raise the possibility of a change to a new standard.

Below is an extract from wikipedia

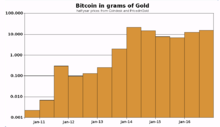

Bitcoin in grams of goldAccording to research produced by the Bank of Canada, the emerging Bitcoin economy has many similarities with the economy based on gold standard, in particular:[86][87]

limited and predictable supply of the anchor of the monetary system

no central bank or monetary authority controls the supply

low or non-existent inflation

virtually no arbitrage costs for international transactions

Governments have less control over their domestic economies

Governments lose seigniorage revenues that they obtain from the ability to almost costlessly create money

Edward Hadas and Michael Hiltzik noted that monetary systems based on Bitcoin and gold have some similar disadvantages:

George Gilder, a proponent of gold standard, proposed breaking "the government monopoly on money" by using a combination of Bitcoin for the internet and treating gold in tax terms as currency.[90][91]

Bitcoin and other cryptocurrencies are a thorn in the side for conventional Fiat currency which have all abandoned the gold standard of the past when they started to print money as and when they needed. In time of Crisis many people move investments into gold as a safe haven, however holding gold presents a problem its heavy and incurs storage costs and not convenient for day to day shopping. In early times it was not unusual to chip bits off a coin to make payments.

cryptocurrencies can be used both for shopping and person to person transactions protected by blockchain’s. They can easily be moved across borders, even though some countries and the EU are looking at ways of restricting this. It is only when you exchange fiat currencies to and from cryptocurrency that governments may be able to glean information from exchanges. It might make sense for forward looking governments to accept cryptocurrency payments/

Banking is already starting to suffer because the cost of moving money from one country to another via cryptocurrency is minimal compared to fees charged by banks. Also ordinary people are now moving savings into cryptocurrencies which are building a history of yearly growth higher than saving rates.

The use of bitcoin as forex instrument has been explored by banks in the past. A notable example is that of Shinhan Bank, a major South Korean financial institution that began a remittance service in the Korea – China corridor, with bitcoin. Faster, near-instant settlements at significantly lower costs are some of the straightforward benefits of using bitcoin in remittance.

David Ogden

Entrepeneur

Steven Cavan

1. Backup today

1. Backup todayYou can never say it enough: back up your wallet. If you haven’t yet backed up your wallet, do it now.

Most hardware and software wallets use an industry standard backup protocol called BIP 39 that allows your wallet backup to be 15 English words.

It"s important to write the words down, on paper, in order, and securely store the backup somewhere safe from people, water and fire. If you don’t back up your wallet, you could well lose your bitcoin. Forever. Greater security involves using a brain wallet https://en.bitcoin.it/wiki/Brainwallet

The new year is a perfect time to check on your important papers, including your wallet backups. Can you still access them? Can you still read the words? Are they secure from fire, water and theft? If you"ve given the backups to someone else (lawyer, accountant), ask them to check their storage.

While we all know we should be checking our backups, wallets and estate plans regularly, it"s hard to remember to do it. Add a reminder to your calendar now, to check all these things again in three, six or at most 12 months.

I have never been a fan of having money or bank information on my phone and with the increase in the Cryptocurrency prices, you might be shocked at how much money you"ve been carrying around on your smartphone.

Now is a great time to move your coins onto a hardware wallet or into cold storage. Hardware wallets are very easy to use, with user-friendly software components, and are considered one of the safest ways to store bitcoin.

While it"s great to carry petty cash or spending money on your phone, never carry more Cryptocurrency on your smartphone than you would carry as cash in your wallet. maybe create a separate wallet just for your phone

If you have coins sitting on an exchange, move them out today to a wallet you control.

Most of the popular exchanges pool coins and while you have a "balance" showing on your account, you do not actually control the keys. If the exchange gets hacked you could lose your money. Remember that you only control the chryptocoins if you control the keys: "not your keys, not your bitcoin".

Add two-factor authentication to your bitcoin-related accounts and to all other important online accounts. The best two-factor solution is a hardware token and you can buy one for just $20–$30.

Otherwise use a smartphone authentication app, such as Authy or Google Authenticator. SMS is not a very good two-factor solution, though it is still better than none at all.

Humans are great at identifying patterns and that makes us terrible at randomness. Password best practises – choose a different random password for each site, never write them down – pose management problems.

For most people, the only way to accomplish this is to use a password manager – one which generates and stores your passwords securely on multiple devices. Popular managers include 1Password, Roboform, LastPass, and the open source KeePass.

Many offer free basic services, with premium services costing less than $80 per year. They"re easy to use and in just a couple of weeks you’ll never want to be without one again.

If something happened to you tomorrow would your family be able to access your cryptocoin? While this tip takes time to implement, it"s worth it.

It shouldn’t take you more than an hour to make a plan and decide who you want to get what, write down instructions and tell your family about your plan.

Be sure to consult an attorney, to make sure your plan is consistent with local law and can’t be challenged in a court. If you have a will, trust, or other estate plan, let your attorney know that you have new assets that need to be included in your plan.

Getting your first Cryptocurrency is becoming easier and easier, but keeping it safe from hackers, insolvent exchanges, and loss isn"t as easy.

These 8 tips will help you bring in the new year with a renewed sense of confidence that you can safeguard the Cryptocurrency that you have, especially now that it’s worth a lot more.

David Ogden

Entrepreneur

Steven Cavan

Source: https://www.cryptocoinsnews.com/republic-georgia-introduce-blockchain-platform-real-estate-documents/ Samburaj Das on 02/01/2017

The country of Georgia is set to introduce and implement a blockchain platform that will enable citizens to receive information about real estate digitally from documents stored on the distributed ledger.

Announced last month by Georgia’s Minister of Justice Tea Tsulukiani, the blockchain platform will be put to use this year, in 2017.

Reported by regional publication CBW, the official added:

“Thanks to efforts of Public Registry, Georgia is ready to join this system. We suppose that in 2017, as the first step of insertion of documents, we will store real estate extracts in the system. We will provide detailed information for our citizens. The main thing is that we have attained technical compatibility. As a result, Georgia will be one of the first countries in our regions and western Europe to establish this technology.”

News of Georgia’s sweeping state-backed move to store real estate documents on a blockchain follows other similarly notable endeavors in recent times. For instance, the Dutch city of Rotterdam announced its aim to develop a blockchain project pilot that will conclude legally binding lease contracts in real estate within the city.

Sticking with Netherlands, banking giant ABN AMRO launched a blockchain application called Torch, last month. Developed in partnership with IBM, the blockchain app will record details accessible by buyers, sellers, landlords, tenants, banks, notaries and even regulators.

Moving stateside, properties in Cook County in Illinois, US, will be the first to be conveyed on a blockchain by a government agency. Developed by Velox, a blockchain technology provider, the project will help provide better information on vacant Chicago buildings to prevent fraudulent conveyance of property. The government office sees blockchain technology to enable a ‘next generation land records system’ and is among the earliest known efforts of a government agency tapping the bitcoin blockchain for a real-world project.

Dennis Roeder

Markethive Member

skype: daroeder

Steven Cavan

Bitcoin’s price versus the US dollar is the most searched keyword for Bitcoin, along with “What is Bitcoin?” The

Bitcoin price is important under many circumstances, primarily exchange rates with any fiat currency, which are

based on US dollar rates to some extent.

Now that Bitcoin’s price has more than doubled since January, the Bitcoin trolls and haters are noticeably silent this

holiday season (funny how that works). Now that the good times are rolling, again–for Bitcoin as a global currency and

an exchange of value–how far can this go? What is the ceiling for “the future of money”?

Some in the mainstream have actually been beating the drum in favor of Bitcoin as a long-term investment. Henry Blodget

of Business Insider used Bitcoin’s peaking value (back during the Mt. Gox bubble in the fall of 2013), to pontificate a $1 million

value down the road. That article received over 100k views, at a time when Bitcoin couldn’t have been more exciting to the mainstream,

leaping from $125 USD to over $1000 USD in one fiscal quarter.

Not too long ago, The Street took Bitcoin blogger Datavetaren’s word in a recent interview that not only will Bitcoin reach $1 million USD in value,

but it will replace gold as the economic “safe haven” of choice. In a Bitcoin bull market, are we just taking a trip to Fantasy Island, or

is there real digital gold in these economic graphs, long-term?

If you look at Bitcoin from all sides, it is hard to come up with a failing conclusion, if you go out far enough. As Nick Cary

tweeted this morning, Bitcoin daily transactions are setting records this holiday season, passing 100k per day, so demand

and usage are at all-time highs. As Bitcoin price continues to increase, the mainstream media struggles to castigate the digital currency.

Bitcoin will undergo a halving next July, dropping production to 12.5 BTC every ten minutes, which certainly won’t hurt Bitcoin’s price in

the long run. This may cause miners to sell more Bitcoin holdings to maintain operations in the short-term, so there will be attrition at play.

This can act as a counterbalance to the natural appreciation, at least for awhile–don’t expect BTC values to double by next fall, but I would

be bullish over time on Bitcoin values. When demand, which is increasing steadily, swamps supply, prices rise over time.

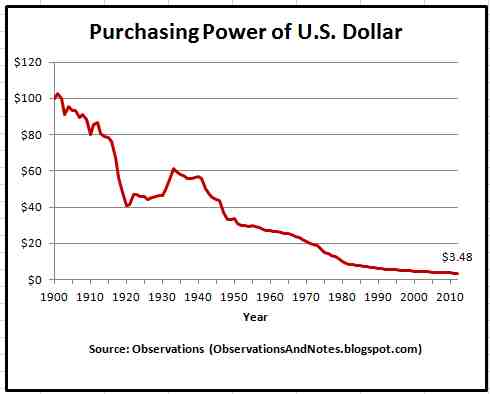

A factor no one talks about is the long-term value of the “global reserve currency,” the dollar itself. The US government will tell you inflation is

a mere 2% at worst, and many times, they’ll even say there is no inflation at all if you let them. Anyone who has bought a car, a pound of beef,

or a bitcoin for that matter will tell you otherwise. Real-world inflation–not the contrived and manipulated CPI–is more like 5% per annum, not 2% or less.

Many experts are also forecasting the end of the U.S. dollar’s run as the global reserve currency by the end this decade. Superpowers like Russia and

China are working night and day to upset the global economic dollar-based shopping cart. The AIIB (Asian Infrastructure Investment Bank) and the

BRICS (Brazil/Russia/India/China/South Africa) have created a we-hate-the-dollar investment bank, and new Silk Road construction from China, through

Russia, into Eastern Europe are all signs of a geopolitical economic shift for the ages.

In an environment where the U.S. is $18 trillion in debt, where non-dollar denominated bilateral trade agreements are the norm and countries worldwide

are using the Chinese yuan for global exchange, the US dollar is on the clock. It’s not a matter of if, but when there is a changing of the guard.

The dollar has lost over 97% of its value over the last century, and why wouldn’t that model of consistent economic debasement continue?

Bitcoin’s value is being rated against a depreciating paper asset with a bad heart. We all do this by default, but I could write 3000 words on why a

bitcoin is more valuable than a dollar, and the market agrees, obviously. In the end, the question may not be how many dollars a bitcoin is worth–every

fiat currency known to man has collapsed, and the U.S. Dollar will be no different. Its final destination will change the future of money even more than Bitcoin will.

I have no doubt a Bitcoin will be worth $1 million USD, not so much because of the strength of Bitcoin as a global currency, but because of the inherent

weaknesses in the US dollar going forward. Global support and confidence in the dollar is fading while Bitcoin continues to rise. “The Third World”

hasn’t even grasped the value of Bitcoin yet.

The billions of dollars invested is still 1-2 years from bearing fruit, making Bitcoin easier and more capable to use, worldwide. Bitcoin has proven its mettle,

and it’s still in the foundation-building stage of its development arc. It may take a decade, but Bitcoin value is not something worth worrying about, over the long run.

The only real question is: will your investment be there when it does?

Richard Tipsword

Learn More

Disclaimer: The information contained herein is not guaranteed, does not purport to be comprehensive and is strictly

for information purposes only. It should not be regarded as investment/trading advice. All the information is

believed to come from reliable sources. NewsBTC does not warrant the accuracy, correctness, or completeness of information

in its analysis and therefore will not be liable for any loss incurred.

original article from NEWSBTC

Steven Cavan